TitanSwap is using the renBTC protocol to implement cross-chain operations. Compared with the currently more common custodial cross-chain solutions wBTC and tBTC, the renBTC smart contract is a non-custodial access mechanism. Its core is the RenVM virtual machine, a decentralized network mainly composed of thousands of “dark nodes” Run on. Therefore, TITAN’s solution is more decentralized and practical.

In addition, under the AMM model, price discovery and the risk of liquidity providers are largely determined by the Bonding Curve.

TitanSwap proposes the TITAN Adaptive Bonding Curve, which automatically adapts to different bond curves for different asset types, which will bring greater liquidity and a perfect combination of better price discovery mechanisms to ensure that users can obtain Smaller slippage, lower costs, and more systematically provide greater liquidity.

TITAN believes that the main reason for impermanent losses is price fluctuations, especially violent fluctuations.

TitanSwap’s solution is to dynamically adjust the curvature of the Bonding Curve to make the curve steeper when the price fluctuates sharply, thereby reducing the profit margin for arbitrageurs and making the price return to the normal price more quickly and at a lower cost.

TitanSwap will determine whether it needs to dynamically adjust the curvature based on Realized Variant and the way of VPIN. This scheme is similar to the implementation mechanism of Bancor V2, but Bancor V2 requires price oracle recognition, and there may be cases where the oracle fails.

A previous report by Huobi Research Institute showed that regardless of the sharp rise or fall in the price of digital assets, VPIN’s predictions will often increase substantially. It has a certain predictive effect and can be regarded as a leading indicator of volatility. Options trading, market makers’ provision of liquidity, and exchange risk control management are of guiding significance.

When discussing how to deal with extreme challenges such as network congestion, the Layer 2 support solution proposed by TitanSwap is also very interesting.

When considering the use of Layer 2 technology, TITAN hopes to achieve exponential improvements, and TITAN considers using state channels or unmanaged side chains. TITAN believes that its Layer 2 support solution is more suitable for using Optimistic Rollup. TITAN will gradually realize the support of this solution on the Ethereum official network in the process of cooperation with Optimistic Rollup.

From the perspective of transaction fees and transaction delays, Layer’s solution exploration will greatly enhance the user experience. Odaily Planet Daily believes that the sooner players who land on the application will be the first to get a considerable first-mover bonus in the DEX market.

TITAN wants to provide participants with new opportunities for liquidity mining.

In addition to the trading function, another major aspect of the current DEX is the liquidity mining.

No matter CEX or DEX, all exchange relies on market makers to provide liquidity and depth to the platform. However, the market makers of traditional centralized exchanges need to play a professional role, and it is not possible for all ordinary users to participate in the work of market makers.

The reason why the AMM-based DEX can emerge is also because it removes the professional threshold requirements for market makers, and anyone can inject liquidity into the pool and obtain benefits.

TITAN hopes to provide liquidity providers with a feast of profit. The current income composition of liquidity providers on TITAN includes AMM fee income, liquidity distribution under the corresponding weights of different trading pools TITAN, stable currency Compound Pool lending rates, and stable currency Y Pool loan interest rate, Synthetix Pool reward, Ren Pool reward, etc.

However, more often, the hidden rule of liquid mining is that only big players can become the final winners, and small money holders are almost unprofitable.

How to balance the relationship between large liquidity providers and ordinary liquidity providers, so that ordinary participants can participate fairly has become a big problem.

Under the AMM mechanism, liquidity depends on the amount of funds. If the purpose of DEX is to provide users with better depth, it must not exclude larger liquidity providers. The larger the funds enter the pool, the better user trading experience can be achieved.

TitanSwap hopes to provide users with better depth and achieve a balance between liquidity providers of different sizes.

TitanSwap revealed that TITAN will hold some special events that emphasize the balance of revenue and profitable for small and casual users. In the short term, it will encourage more people to participate in DEX, hoping that more people can experience the operation process of liquid mining.

DEX is not just a train to casinos, DEX itself also has a strong wealth effect.

On September 17, Uniswap announced the launch of the governance token UNI, and then airdropped 150 million UNI to nearly 50,000 addresses that had invoked Uniswap V1 or V2 contracts. We joked that “an iPhone 12 was allocated to everyone.”

TitanSwap also designed the governance token TITAN, with a total amount of 1 billion. At present, the main way for users to obtain TITAN is trading and liquidity mining. Holders have the right to propose and vote, and can jointly determine part of TITAN’s future governance rights.

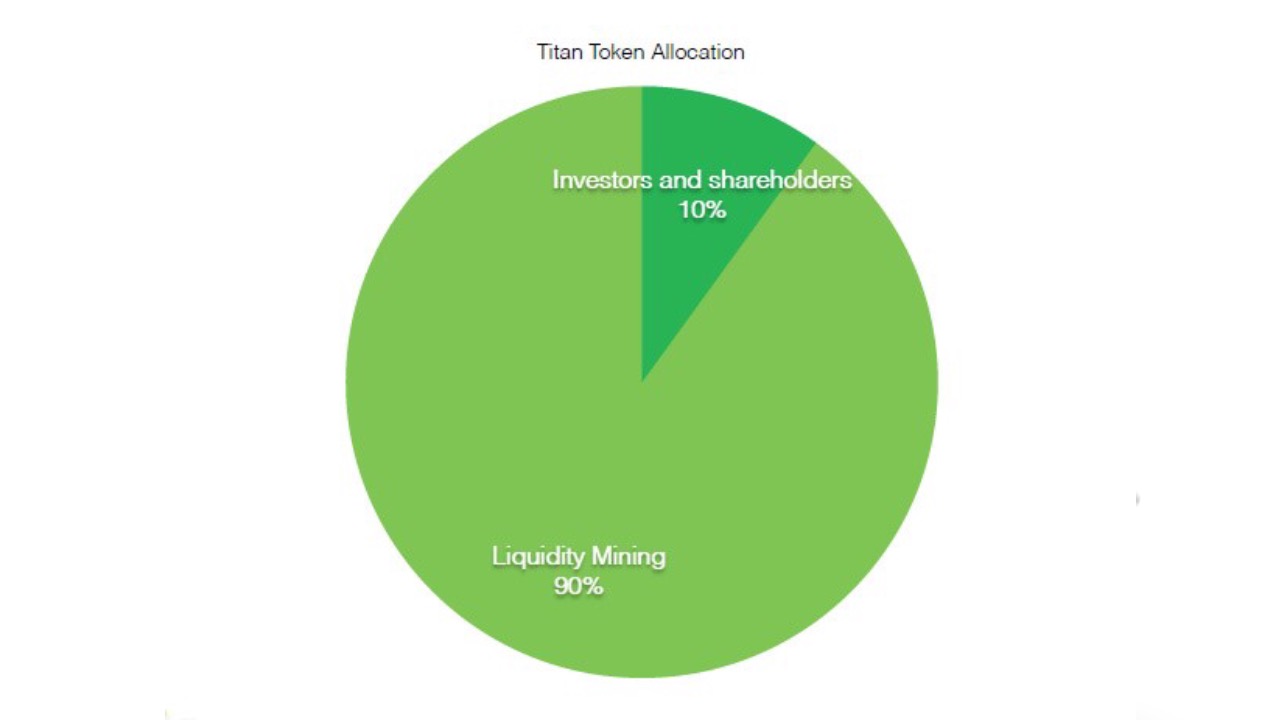

In terms of distribution, TITAN promised to release 90% of TITAN tokens through liquid mining. The team has no pre-mining and no reservation. 10% of the tokens are sold to investors as start-up capital, after which the TITAN project becomes a true decentralized community project. This ratio is already much higher than most DEX projects.

However, DeFi and liquid mining have indeed pushed DEX into the mainstream ahead of time. When DeFi is no long popular, how much market space will remain for DEX?

The official TitanSwap team stated that the distribution of TITAN will be consistent with the growth process of the entire network. As the network transaction volume increases, the liquidity of TITAN token distribution will increase, so that when TITAN is used more, there will be more users holding TITAN tokens.

This design is actually to keep the tokens from being concentrated in the hands of early large liquidity providers as much as possible.

“In this way, the annualized rate of return may be relatively low, but TITAN pays more attention to the long-term incentives rather than short-term. We don’t want to leave the market with a mess.” Ghughur said.

At 8pm on September 24, Huobi launched TITAN together with a “new coin mining” event for TITAN. This event will provide 4 million TITAN tokens as a reward for participating in the new coin mining activity for the lock-up users, with the total lock-up limit of 8 million HT.

The birth of TitanSwap brought a more interesting arbitrage tool to this game of DEX.

We believe that DEX and CEX would coexist for a long time in the future, but the future DEX will definitely move towards integrating more CEX functions. TITAN is likely to use its first-mover advantage to become a breaker in the future DEX ecosystem. Whether it will break through the current dominance of Uniswap or bring new wealth to the market, TitanSwap is worth looking forward to.

Press Contact Email Address

elainewang@ysmedia.net

Supporting Link

https://titanswap.org/#/

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Image Credits: Shutterstock, Pixabay, Wiki Commons